Powerful Tools For Mutual Fund Research

Category wise Return & Risk Ranking

Performance parameters and recommendations of fund rankings in terms of quality of return, volatility, and risk incurred.

Category Performance Snapshot

Categorizing and indexing fund's performance over multiple time frames to understand its risk adjusted returns, ratios, and portfolios.

Scheme Performance, Ratios & Highlights:

A detailed insight into scheme performance, the asset allocation of the scheme and how it has been constructed over time.

Compare: Scheme, Index, Currency, Commodity...

Money, Seriously!!

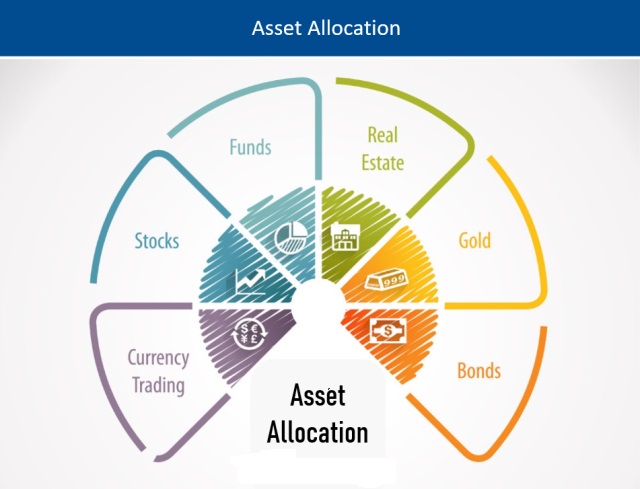

Mutual funds have become a popular investment option in recent years, as they offer the potential for higher returns than more traditional investments such as savings accounts or bonds. However, merely tracking the historical returns and fund rankings will not help you choose the right fund. Here, we discuss topics such as investment objectives, levels of financial freedom, performance parameters, and how they will help you understand what to look for in a fund. We will also cover some key concepts such as risk and return, asset allocation, and diversification.

To equity or not to equity

As we come to the start of calendar 2024, it is time to take stock of the current state of the economy and what it holds for us moving forward. But before we delve into the subject let us take some ti...

Read More

Making sense of the conflicts and the Markets

It is the season to feel a bit lost for most of us in West Bengal and for many others all over the world. Our favourite daughter had come home with her children and she left us to return to her own ho...

Read More

Asset Allocation: The magic mantra

Markets rise and markets fall. Industries and sectors come and go out of focus and attention. Hot shot companies and their share prices see insane growth and then loose it all while some other “new”...

Read MoreCalculator

Our financial calculators can help you determine the best investment strategy for your needs taking into account your investment objective, level of financial freedom, and other performance parameters.

Experts Interviews

Vihang Naik

Chief Investment Officer

Baroda Asset Management India Limited

Aniruddha Naha

Director & Senior Fund Manager

PGIM Investments

Sanjay Chawla

Chief Investment Officer

Baroda Asset Management India Limited

Shridatta Bhandwaldar

Head Equities

Canara Robeco Mutual Fund

Shreyas Devalkar

Fund Manager

Axis Mutual Fund

Testimonials

Don’t just take our word for it.

Are you a financial Advisor

We provide a range of services for financial advisers, including access to our fund research, performance data and analytical tools that will help you make the best investment decisions for your clients.

DiscoverPremium screens on various themes

Forecasts for price, revenue and EPS

Download data for offline analysis

Premium and customizable filters

Ask An Expert

We bring a wealth of expereince and know-how to the table.

Vikash Kumar

Vikash Kumar

"There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly ..."

Vikash Kumar

Vikash Kumar

"There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly ..."

Vikash Kumar

Vikash Kumar

"There are many variations of passages of Lorem Ipsum available, but the majority have suffered alteration in some form, by injected humour, or randomised words which don't look even slightly ..."

Frequently Asked Question

The mutual fund industry is rife with different types of funds, strategies, and terminology.

We are here to help you make sense of it all.

Mutual funds are set up by a fund manager who pools the money of many investors to invest in stocks, bonds, and other types of investments. The mutual fund is managed by the fund manager, who develops an investment strategy with the help of a team of financial professionals.

Mutual fund schemes come in a variety of types, each with its own investment strategy and goals. The most common scheme categories are equity funds, debt funds, hybrid funds, index funds and sector-specific funds.

Know Your Scheme

When considering schemes, it's vital to know the risk levels, returns, and other parameters, like asset allocation and periodic rebalancing, for the respective fund categories.

Get Started